Golden Age of Fraud

Source: My iPhone.

Recently, I received a very nice email about my debut novel, Bit Flip. It was a detailed and thoughtfully crafted message, saying the book “really caught my attention,” particularly its “portrayal of the tech world’s seductive illusion and the moral price of ambition” that felt “both timely and deeply personal,” concluding that it was a “truly impressive work!”

In my momentarily flattered state, I assumed this message was sent by a legitimate reader and was about to reply with a gracious thank you. Then I noticed another eerily similar email in my inbox, also sent from an anonymous Gmail address. Then another similar message arrived, and another, and another after that—each unique but all using the same obsequious language in an attempt to lure me into a response.

If you are a published author, or perhaps run a small business, or maybe you’re merely a human being with an email address or mobile phone, you recognize what this was: one of the dozens of fraud attempts most of us receive every day. But these are no longer your parents’ phishing scams. Unlike the promised inheritance from a Nigerian prince, online fraud today has become far more personalized, sophisticated, and pervasive—aided, like everything, by AI.

In short, online fraud is rampant.

Source: FBI Internet Crime Complaint Center, https://www.ic3.gov/

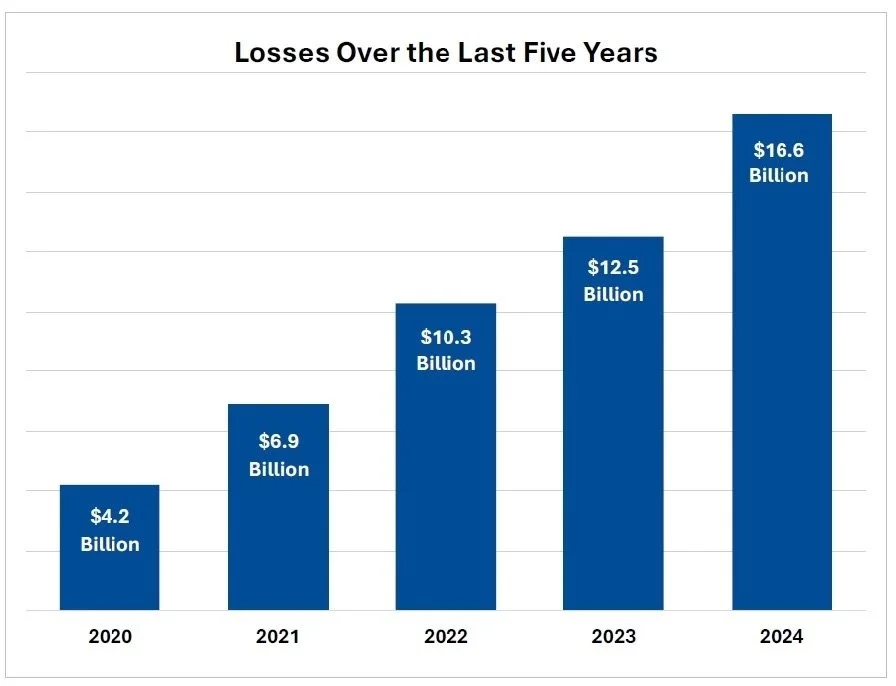

A recent survey by the Pew Research Center found an astonishing 73% of U.S. adults have been the victim of an online scam or attack, spanning every age, ethnic, and income group. The cumulative financial impact of all that fraudulent activity was $16.6 billion in 2024 alone, according to the FBI’s Internet Crime Complaint Center, and that’s just what is reported. The actual number is certainly much higher due to the embarrassment often felt by victims. The same Pew survey found 74% of victims never report the crime to law enforcement.

Even more jaw dropping than the size of that number is its rate of growth, a 33% increase from 2023 and a 4X increase since 2020, making it one of the fastest-growing sectors of the economy. At that rate, online fraud will be a $68 billion problem by the end of the Trump administration, roughly the size of Alaska’s entire GDP. That’s a big problem.

If you consider broader trends, it’s no surprise online fraud has reached epidemic proportions. The conditions are ripe for what I sarcastically refer to here as a “Golden Age of Fraud.” These conditions include:

Easier Perpetration—Conducting a convincing scam used to be difficult, expensive, and time-consuming. Not any more. Fraudsters can use the same tools as legitimate businesses—including no-code platforms to build websites, cloud computing for storing stolen user data, and real-time payments from Zelle to Bitcoin for seamless financial transactions—to fool even the most savvy consumers and businesses. These tools have taken the friction out of fraud.

Better Personalization—The key to a good scam is making it believable, and personalizing it (as my book scammer did) makes targets more susceptible to belief. AI tools are making it easier by the day to do this, including everything from custom-tailored pitches using generative AI to voice, image, and video deepfakes impersonating family members or business colleagues. Modern scams exploit trust in the people we know.

Broader Reach—Scale is another critical component of an effective fraud scheme. If only 1% of targets fall for the scam, it’s not worth doing if you can only reach 100 people. If, on the other hand, you can reach 100 million people, you have one million successful victims. Digital platforms, borderless connectivity, and low operating costs all enable fraudsters to dramatically expand their reach.

User Confusion—Modern consumers as well as businesses (particularly small businesses) are ill-equipped to keep up with the pace of technical change, creating new vulnerabilities for fraud. As legitimate businesses implement more and more counter-fraud measures, such as two-factor authentication, text-based account alerts, and automated purchase updates, it becomes more and more difficult to distinguish between legitimate commercial activity and fakes.

Lack of Enforcement—Online fraud is incredibly hard to prosecute because the perpetrators are frequently operating across international boundaries. Does anyone think China or Russia or Iran will cooperate with US law enforcement in cyber crime investigations? Furthermore, at a time when we need it most, our own internal law enforcement and regulatory oversight organizations are being slashed. The Trump administration is cutting funds to the Cybersecurity and Infrastructure Security Agency (CISA) out of a self-serving desire to curtail that organization’s attempts to stem the spread of election misinformation, and current FBI Director Kash Patel seems more interested in pursuing imagined internal enemies than protecting Americans from cyber crime.

The net of all this is the depressing recognition that conditions are perfect for online fraud, and that it will only get worse before it gets better, if it ever does. Even though 79% of Americans feel online fraud is a major problem, the current administration seems unwilling or unable to safeguard us. Consumers and businesses need to be more vigilant than ever to avoid financially devastating scams. Unfortunately, as is often the side effect of our lives led online, with that vigilance comes less trust, more confusion, and greater cynicism in human kind. In the meantime, don’t answer those unrecognized numbers on your phone.